Edited by Santosh Satyapal | Debo Times. In | Updated: 7 Feb 2023, 04:25 pm

Highlights:

• Adani also dropped out of the top 20 in the list of the world's richest people

• Questions are being raised about India's credibility.

• Adani has been close to Prime Minister Narendra Modi for decades

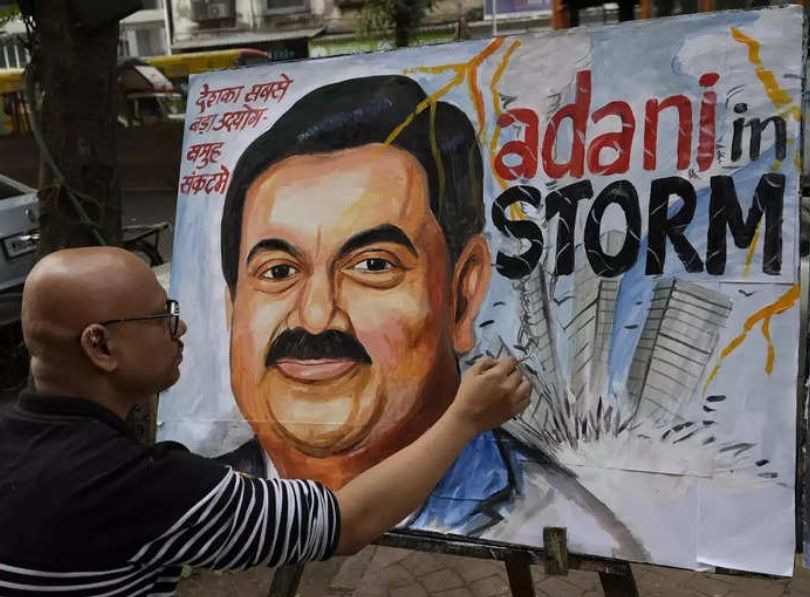

New Delhi: A report by American short-seller research firm Hindenburg has put the sleep of Gautam Adani, the Adani Group, and their investors, who are eager to get high. Everything changed in just 10 days. The Hindenburg Research report leveled major allegations against the Adani group - from money laundering to accounting fraud. Concerns had already been raised about the group's huge debt. The Hindenburg report had a major impact on the stock market in the past few days, though the Adani group has denied the allegations and downplayed debt concerns.

• ADV- Trending Deals of the Day on Mobile Phones- Get the most affordable 4G phones at the lowest prices

The Hindenburg Report took the Adani Group discussion from the domestic level to the international level. Adani, which was ranked second in the Bloomberg Billionaires Index, slipped to 21st place within days. Adani Group is not a small conglomerate but its investments range from airports, and power plants to ports. All goods entering and leaving the country pass through this group. Gautam Adani has had a close relationship with Prime Minister Narendra Modi for decades. He is one of the few industrialists who have partnered with the Modi government in pushing forward its development agenda, and the allegations have shaken investor confidence, which is a matter of concern. Not only the Adani Group but also the Indian market and the entire system. The claims of the Hindenburg Report are yet to be verified. But, too much damage has already been done.

Allegations on Adani, India's economy at risk The

Adani group was accused at a time when China's economy is opening up. If Hindenburg accuses the Adani group, it is feared that it will have repercussions on the Indian economy. Banks are also likely to suffer huge losses due to the Adani Group crisis. The report, released on January 24, 2023, has shaken the Adani Group. The Adani Group has investments in several infrastructure projects across the country.

A report by a small American company has shaken investors' confidence in the giant Adani group. The fall in Adani Group shares is proof of this. But this is not limited to the Adani group. The country's regulatory framework has also come under the scanner. There are many questions in the minds of foreign investors. Since the Hindenburg report, Adani Group's market capitalization has declined by more than $100 billion.

Fears among financial institutions too

The allegations against the Adani group have also rocked two of the country's largest financial institutions (SBI). State Bank of India (SBI) fell 11 percent after the Hindenburg reports while foreign institutional investors (FIIs) withdrew $2 billion from the Indian market from January 27 to January 31. This clearly shows that the interest of investors is waning in the Indian market.

This message will be negative for investors as there is a huge uproar in both houses of Parliament over the allegations against Adani. Because such cases raise questions about India's regulatory framework. India's credibility as an engine of global growth is being questioned. All in all, the Adani Group crisis certainly does not bode well for the Indian economy.

Adani Group: Hindenburg shock shakes Adani empire, what a blow to Indian economy

Author: Santosh Satyapal | Sr.Reporter